Installment Loans: Smart Financing for Long-Term Needs

The Ins and Outs of Loans: Navigating Your Funding Selections With Confidence

Maneuvering the complicated landscape of loans needs a clear understanding of different types and essential terminology. Many people locate themselves overwhelmed by options such as personal, auto, and student loans, in addition to vital ideas like rate of interest prices and APR. An understanding of these fundamentals not just help in reviewing monetary needs but additionally boosts the loan application experience. There are significant variables and typical challenges that consumers ought to identify before proceeding further.

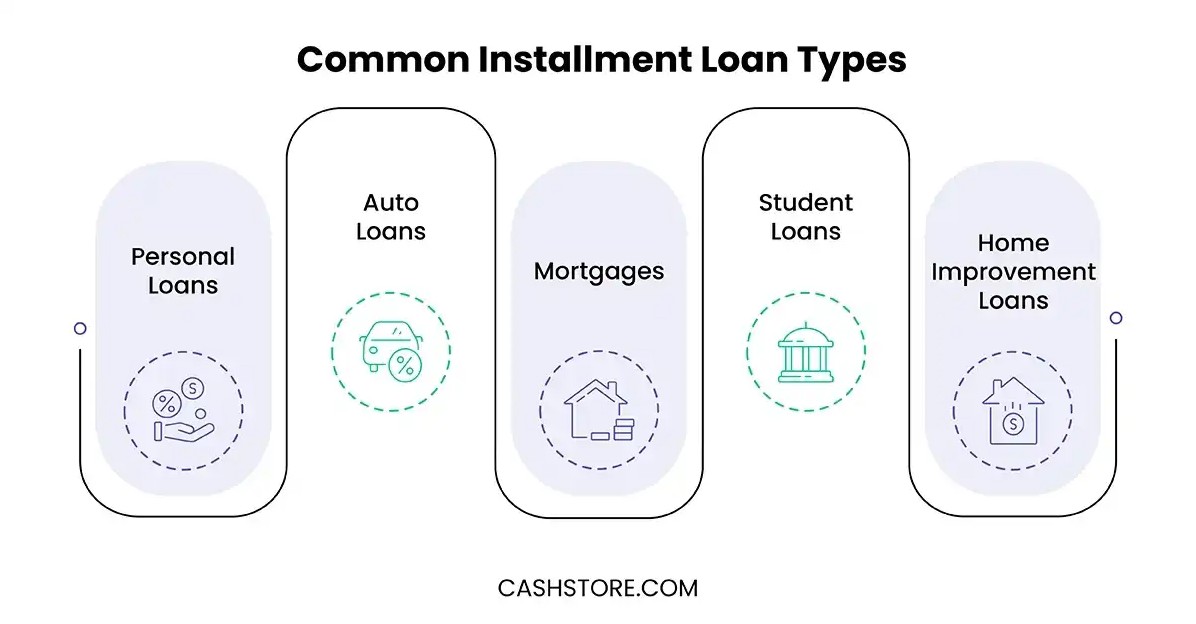

Understanding Different Kinds Of Loans

Loans function as important monetary devices that deal with various requirements and purposes. Services and people can pick from numerous kinds of loans, each designed to meet specific needs. Individual loans, often unprotected, give consumers with funds for various individual expenses, while car loans make it possible for the purchase of cars through secured funding.

Home mortgage, or home loans, aid purchasers in obtaining property, typically including long payment terms and particular passion rates. Student loans, targeted at funding education, usually featured lower rate of interest and deferred settlement options up until after college graduation.

For organizations, commercial loans provide needed capital for growth, devices acquisitions, or operational expenses. Furthermore, cash advance give fast cash remedies for urgent demands, albeit with greater rate of interest. Recognizing the various sorts of loans permits borrowers to make informed decisions that line up with their economic objectives and scenarios.

Key Terms and Ideas You Ought To Know

Recognizing vital terms and ideas is necessary when navigating loans. Rates of interest play a crucial function in identifying the cost of loaning, while different loan types accommodate different monetary requirements. Familiarity with these aspects can empower individuals to make informed choices.

Rate Of Interest Clarified

Exactly how do rate of interest impact borrowing choices? Rates of interest represent the price of obtaining money and are an essential variable in economic decision-making. A higher passion rate increases the total price of a loan, making loaning less attractive, while reduced prices can incentivize debtors to take on financial obligation. Lenders use interest rates to minimize threat, reflecting consumers' creditworthiness and prevailing financial problems - Payday Loans. Dealt with rate of interest stay consistent throughout the loan term, providing predictability, whereas variable prices can fluctuate, possibly bring about greater payments in time. In addition, understanding the interest rate (APR) is vital, as it includes not just interest but likewise any kind of associated costs, providing a thorough view of loaning expenses

Loan Enters Summary

Maneuvering the landscape of loan types is critical for customers seeking the most ideal financing alternatives. Recognizing different loan types helps people make notified decisions. Individual loans are typically unprotected, excellent for consolidating financial debt or funding personal jobs. Home loans, on the various other hand, are protected loans particularly for acquiring property. Vehicle loans offer a similar purpose, financing lorry purchases with the automobile as security. Business loans deal with entrepreneurs needing funding for operations or expansion. Another choice, student loans, help in covering academic costs, frequently with positive settlement terms. Each loan kind offers distinctive terms, rate of interest rates, and eligibility criteria, making it necessary for consumers to evaluate their financial needs and capabilities prior to committing.

The Loan Application Process Clarified

What actions must one take to effectively navigate the loan application procedure? People should analyze their financial demands and identify the kind of loan that aligns with those demands. Next, they must review their debt report to validate precision and identify areas for renovation, as this can affect loan terms.

Following this, customers have to gather essential documentation, consisting of evidence of income, work background, and economic declarations. Once prepared, they can come close to loan providers to inquire regarding loan items and rate of interest.

After picking a loan provider, finishing the application form precisely is important, as mistakes or omissions can delay handling.

Lastly, candidates need to await potential follow-up requests from the lending institution, such as added paperwork or clarification. By adhering to these actions, individuals can boost their opportunities of a effective and smooth loan application experience.

Aspects That Impact Your Loan Authorization

When taking into consideration loan authorization, several vital factors come into play. 2 of the most considerable are the credit history and the debt-to-income proportion, both of which provide loan providers with insight right into the customer's financial security. Recognizing these elements can significantly improve an applicant's possibilities of securing the preferred financing.

Credit Score Relevance

A credit score acts as an important standard in the loan authorization procedure, affecting loan providers' perceptions of a consumer's monetary integrity. Usually varying from 300 to 850, a higher rating shows a history of liable credit rating usage, consisting of prompt repayments and reduced credit rating utilization. Numerous aspects add to this rating, such as repayment background, size of credit report, sorts of credit score accounts, and recent credit rating queries. Lenders make use of these ratings to evaluate threat, figuring out loan terms, rate of interest prices, and the probability of default. A strong credit report score not only improves approval possibilities yet can additionally bring about extra favorable loan conditions. On the other hand, a low score might cause greater rate of interest or denial of the loan application altogether.

Debt-to-Income Proportion

Lots of loan providers think about the debt-to-income (DTI) ratio a crucial facet of the loan approval process. This monetary metric compares an individual's month-to-month financial debt settlements to their gross month-to-month revenue, providing understanding right into their capability to take care of added debt. A lower DTI ratio indicates a healthier monetary circumstance, making borrowers much more appealing to lenders. Factors influencing the DTI proportion consist of housing costs, bank card balances, pupil loans, and various other persisting expenses. Furthermore, adjustments in income, such as promotions or job loss, can substantially impact DTI. Lenders normally prefer a DTI ratio listed below 43%, although this limit can differ. Comprehending and managing one's DTI can improve the possibilities of protecting positive loan terms and passion rates.

Tips for Handling Your Loan Responsibly

Typical Errors to Avoid When Securing a Loan

Furthermore, numerous people hurry to accept the initial loan offer without comparing alternatives. This can lead to missed opportunities for far better terms or lower rates. Consumers should likewise stay clear of taking on loans for unneeded costs, as this can lead to long-lasting financial debt troubles. Neglecting to evaluate their credit report rating can hinder their capacity to safeguard favorable loan terms. By recognizing these pitfalls, debtors can make educated choices and browse the loan process with greater confidence.

Frequently Asked Inquiries

Exactly How Can I Enhance My Credit Score Before Looking For a Loan?

To improve a credit score before looking for a loan, one need to pay bills on time, lower outstanding financial debts, check credit scores reports for mistakes, and stay clear of opening brand-new charge account. Constant financial routines generate positive results.

What Should I Do if My Loan Application Is Refuted?

Are There Any Costs Related To Loan Early Repayment?

Funding prepayment costs may use, relying on the loan provider and loan type. Some loans consist of charges for very early payment, while others do not. It is important more info for borrowers to evaluate their loan contract for specific terms.

Can I Discuss Loan Terms With My Lender?

Yes, borrowers can bargain loan terms with their loan providers. Elements like credit history, settlement background, and market problems may influence the loan provider's willingness to customize interest rates, repayment routines, or fees related to the loan.

How Do Rate Of Interest Impact My Loan Settlements Gradually?

Rate of interest significantly affect loan payments. Higher prices cause increased month-to-month settlements and complete interest prices, whereas reduced rates decrease these expenses, eventually impacting the consumer's general financial worry throughout the loan's duration.

Several individuals discover themselves overwhelmed by options such as individual, automobile, and pupil loans, as well as crucial principles like rate of interest prices and APR. Interest rates play a crucial function in establishing the cost of loaning, while different loan kinds provide to different economic needs. A greater rate of interest rate enhances the overall price of a loan, making borrowing less enticing, while reduced prices can incentivize customers to take on financial obligation. Fixed interest prices remain constant throughout the loan term, using predictability, whereas variable rates can fluctuate, potentially leading to greater repayments over time. Finance prepayment fees may use, depending on the lending institution and loan type.